Poorer countries facing sovereign debt crisis

By Nick Beams

The move by the US Federal Reserve and other major central banks to lift interest rates in response to rising inflation threatens to set off a sovereign debt crisis for many so-called emerging market economies and low-income countries.

Numerous warnings to this effect have been made since the beginning of the year as it has become clear that the Fed is planning a “lift-off” in rates, possibly as early as March.

Economists William Rhodes and John Lipsky, who lead the Sovereign Debt Working Group at the Bretton Woods Committee—a semi-official US economic think tank—wrote in the Wall Street Journal this week about growing “challenges” in the sovereign debt market.

“The warning signs of a crisis are already clear,” they stated. “According to International Monetary Fund figures, interest payments on public debt as a percentage of public revenues are four times as high in low-income countries as in advanced economies, while the same ratio in emerging economies is twice as high.”

A decade ago this ratio was similar across all countries, but today, according to the World Bank, some “60 percent of low-income countries are either suffering from debt distress or at high risk of doing so.”

Rhodes and Lipsky noted that mechanisms for dealing with debt restructuring through the so-called Paris Club, an informal grouping of official lenders to debtor countries, had “become muddled and ineffective” and the lack of a debt restructuring process created “market volatility and risk, damaging a broad range of financial market participants.”

In other words, a sovereign debt crisis, in the absence of “restructuring” arrangements, could impact on the global financial system.

Last week Argentina entered a “restructuring” agreement with the International Monetary Fund on a $57 billion loan in order to avoid a default. In the Financial Times (FT), Gillian Tett wrote that the deal should be a “wake-up” call not just in regard to the problems of Argentina, but because it posed the bigger question of “what will happen to the rest of the world’s troubled sovereign debt this year.”

An FT report last month noted that the world’s poorest countries face an increase of $10.9 billion in debt repayments this year. They must repay an estimated $35 billion to official and private-sector lenders in 2022, a 45 percent increase from 2020.

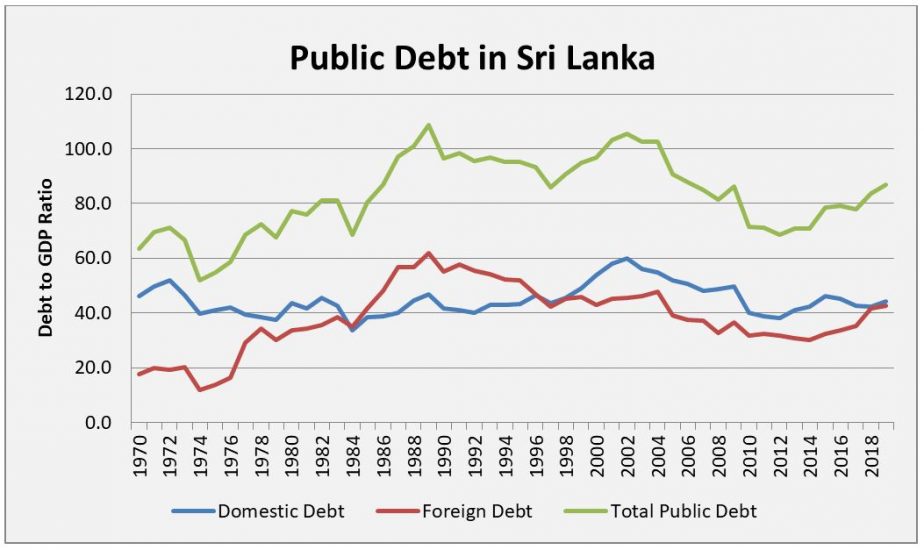

One of the most vulnerable countries is Sri Lanka. The rating agency S&P Global warned last month the country faced a possible default this year as it downgraded its sovereign bonds.

In an interview with the FT at the end of January, Sri Lankan Finance Minister Basil Rajapakse said the government was “negotiating with everybody” and “trying all our options” to avert a default.

Sri Lanka has almost $7 billion in debt repayments due this year but less than $3 billion in foreign currency reserves. More than one third of the debts are owed to international bond holders and the crisis has already led to power cuts and shortages of imported goods, such as fuel and milk powder. Long-dated government bonds are already trading at half their face value.

In Sri Lanka, as in all highly indebted countries, a “restructuring” or outright default will inevitably be accompanied by deepening attacks on the working class, as international finance capital demands that the flow of money into its coffers continues.

Officials at leading international institutions have warned of a growing crisis. World Bank president David Malpass has said the demands of creditors mean “the risk of disorderly defaults is growing.

“Countries are facing a resumption of debt payments at precisely the time when they don’t have the resources to be making them.”

With many countries having to take on more debt to deal with the effects of the pandemic, debt repayments were suspended in 2020. But that period has now ended with an initiative supposedly aimed at relieving debt burdens proving, in the words of the FT, to be a “damp squib.”

A debt suspension plan, aimed at deferring about $23 billion of debt owed by 73 countries, launched in April 2020 and extended to the end of last year, saw only 42 countries obtaining relief totalling just $12.7 billion.

Rebeca Grynspan, secretary-general of the United Nations Conference on Trade and Development, told the FT: “The problems of debt are mounting and the fiscal space of the developing world will continue to shrink. We really are at the risk of another lost decade for developing countries.”

In 2020 and 2021, when the world was awash with money because of the ultra-loose monetary policies of the major central banks, developing countries were able to access international capital markets for funds. But the situation is now changing rapidly as inflation surges around the world.

According to Ayhan Kose, head of the World Bank’s forecasting unit: “Market access is a wonderful thing to have when there is cheap money out there, but there might be a different view as conditions tighten.”

Poorer countries are caught in a dilemma. They can seek relief through an arrangement with the IMF and bilateral creditors to secure new terms and then try to obtain the same arrangement from private creditors. But, as Grynspan noted, if a country publicly admits it has debt repayment problems “the private sector will punish them.”

The turbulence in financial markets, particularly the violent swings in the value of bitcoin, is also causing major problems.

In an interview with the FT this week, Tobias Adrian, the head of the IMF’s monetary and capital markets department, said the price swings in crypto currencies were “destabilising” capital flows in emerging markets.

“Crypto is being used to take money out of countries that are regarded as unstable [by some external investors],” he stated. This posed “a big challenge for policymakers in some countries.”

Adrian said some emerging and developing economies faced “immediate and acute risks” as a result of their established currencies being replaced by crypto assets.

There was also a risk that sell-offs in crypto currencies feed into equity markets and vice versa, creating turbulence that heightens financial risks for highly indebted economies.

Courtesy of the World Socialist Web Site